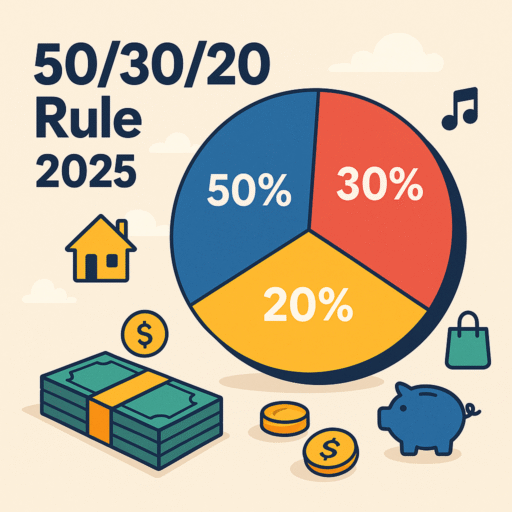

The 50/30/20 rule has been one of the most widely used budgeting guidelines for over two decades. Originally popularized by Elizabeth Warren in her book “All Your Worth,” it was designed as a simple formula to help everyday people manage their money effectively. But in 2025, with rising costs of living, the explosion of subscription services, and the availability of advanced budgeting apps, many people are asking: is this rule still relevant today?

📖 A Brief History of the 50/30/20 Rule

The rule divides after-tax income into three categories:

- 50% Needs: Essentials like housing, food, transportation, and insurance.

- 30% Wants: Lifestyle choices such as dining out, entertainment, shopping, and hobbies.

- 20% Savings/Debt: Building an emergency fund, retirement contributions, paying off debt.

This simple structure gained popularity because it was easy to understand and didn’t require advanced financial knowledge. It provided a flexible starting point for anyone who wanted to control their finances.

💡 Why People Loved This Rule

The appeal of the 50/30/20 rule lies in its simplicity. Unlike complex financial plans, this rule gives clear boundaries. For beginners, it’s less intimidating than spreadsheets filled with dozens of categories.

Its benefits include:

- Easy to apply to most income levels.

- Encourages balance between needs and wants.

- Ensures a dedicated portion for savings and debt repayment.

⚠️ Challenges of Using the Rule in 2025

While the rule worked well in the past, the world of 2025 presents unique challenges:

- High housing costs: In many cities, rent or mortgages alone exceed 40–50% of income, leaving little room for other needs.

- Student loan and credit card debt: Many households spend more than 20% on debt repayment.

- Inflation: Groceries, transportation, and utilities take up more than half of the “needs” category for many families.

- Lifestyle shifts: Subscriptions like Netflix, Spotify, cloud storage, and online services blur the line between needs and wants.

📊 Case Studies

1. A Single Professional in New York

Maria earns $5,000 monthly after tax. Her rent and utilities cost $2,800—already 56% of her income. This makes it nearly impossible to stick to the 50% “needs” rule. Instead, she adapts her ratios to 60/20/20.

2. A Family of Four in Texas

John and Sarah have a combined income of $7,000. Their needs account for 48%, wants for 28%, and they save 24%. The 50/30/20 rule works well for them because housing is more affordable in their region.

3. A Freelancer with Irregular Income

David earns between $3,000 and $6,000 monthly. For him, the rule is harder to apply. Instead, he focuses on ensuring that at least 20% of his income (when high) goes directly into savings and investments to balance the lower-income months.

🔍 Alternatives to the 50/30/20 Rule

Many financial experts in 2025 suggest modifications to adapt to modern realities:

- 60/20/20 Rule: Ideal for high-cost cities where needs exceed 50%.

- 70/20/10 Rule: Focuses heavily on essentials while limiting wants.

- Customized Ratios: Tailored to personal goals, e.g., 40/20/40 for aggressive savers.

📱 How Apps Make It Easier

In 2025, apps like Mint, YNAB, and Goodbudget allow users to set their own percentages. Instead of being locked to 50/30/20, you can create flexible categories that adapt to your spending habits.

✅ Pros and Cons of the Rule

Pros:

- Simple and beginner-friendly.

- Encourages savings discipline.

- Helps balance lifestyle with long-term goals.

Cons:

- Not suitable for everyone, especially in expensive cities.

- Doesn’t account for irregular or seasonal income.

- Too rigid for complex financial situations.

⚖️ Comparison Table

| Rule | Needs | Wants | Savings/Debt | Best For |

|---|---|---|---|---|

| 50/30/20 | 50% | 30% | 20% | General use, beginners |

| 60/20/20 | 60% | 20% | 20% | High-cost cities |

| 70/20/10 | 70% | 10% | 20% | Debt-heavy households |

| 40/20/40 | 40% | 20% | 40% | Aggressive savers |

🌟 Tips for Applying the Rule in 2025

- Track your spending for 2–3 months before applying the rule.

- Be flexible: if your needs take 60%, reduce wants instead of giving up.

- Automate savings transfers to ensure consistency.

- Review your budget quarterly and make adjustments.

📌 Conclusion

The 50/30/20 rule in 2025 remains a valuable starting point for budgeting. However, the financial landscape today is more complex than when the rule was first introduced. For many people, the rule needs to be adapted to reflect local costs of living, debt obligations, and personal goals. The key takeaway: don’t see it as a strict formula, but as a flexible framework to build a sustainable budget that works for your life.

Related Articles: